Your Complete Solution

Our unique take on FX reflects the significant investment in technology and people we’ve made over the past three years. During this time, we’ve partnered with leading software developers to provide you with a stateof- the-art offering that will stand the test of time.

We aim to offer a comprehensive solution that meets all of your trading, hedging and payment needs, all in one place. We are as nimble and dynamic as a start-up, but we’re backed by the experience and trust of a 200-year-old bank.

As One of the World’s Largest Custodians, We Have a Unique, Aerial View of Foreign Exchange

It’s this insight, along with decades spent helping clients navigate the global markets, that enables us to better meet your FX requirements.

TRANSPARENCY & TRUST

We’ve got a client franchise second to none, and that’s largely because of our client-focused approach to managing your assets.

CREDITWORTHINESS

COMPREHENSIVENESS

We’re equipped to provide all the services you are likely to need, with the benefit of a cost-efficient and integrated workflow.

CONNECTIVITY

By partnering with leading third-party platforms, and providing direct access to our e-trading capabilities, we’re making it easier for you to trade.

UNRIVALED INSIGHT

Our global team of seasoned commentators furnishes you with the perspective that only a firm with access to deep flows of funds information can provide.

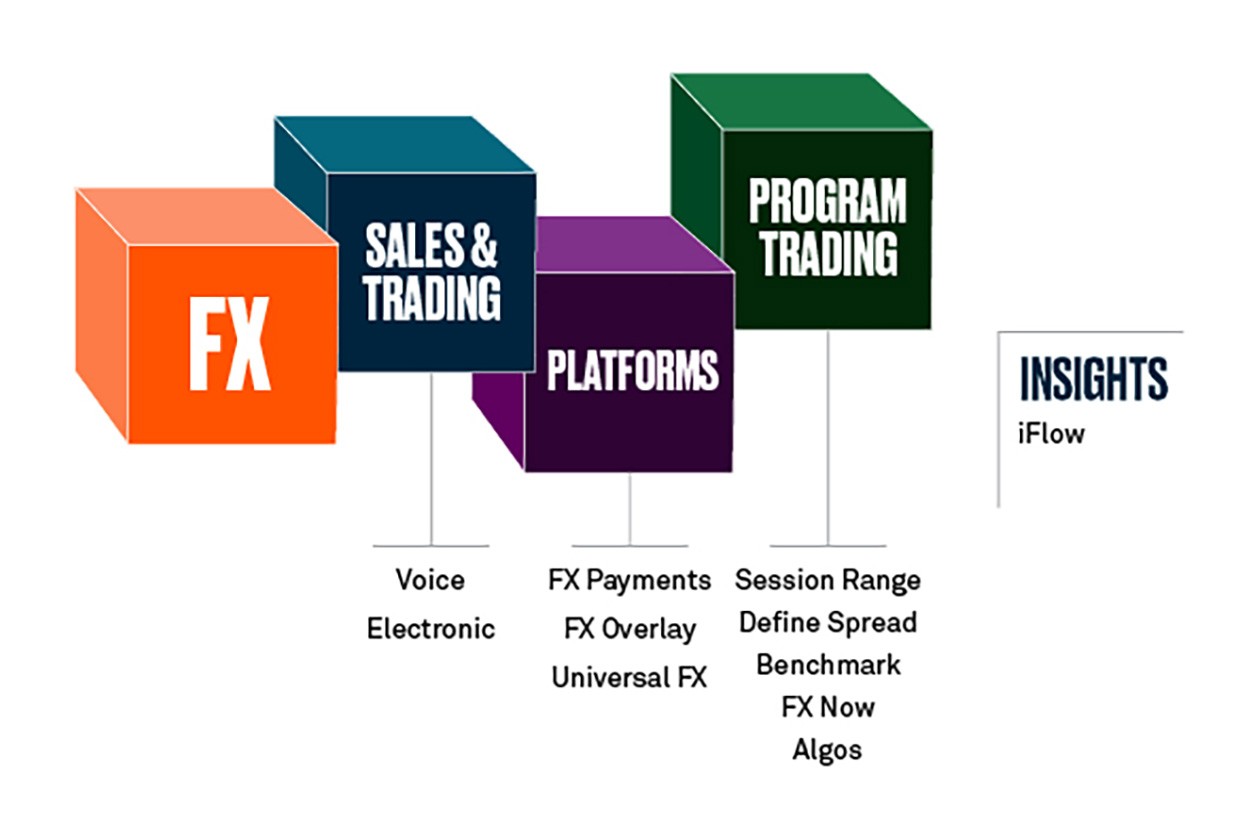

Capabilities

Our range of FX client algos enable you to manage your currency exposure utilizing a number of algorithmic strategies. Learn more about FX Algos.

Whatever your hedging needs, our experienced team of product specialists can create a tailored hedging solution based on your specific requirements.

Whether you are an asset owner or manager, we can take care of your FX overlay strategy, execute hedges, adjustments and rolls, all according to your predefined parameters. We’ll also provide you with comprehensive reporting to ensure full transparency, taking the heavy lifting off your shoulders.

Share Class Hedging

Supporting the distribution of your funds to investors around the globe, while insulating them from excessive currency volatility.

Portfolio Overlay

Mitigates in whole, or in part, the FX exposure within a single or aggregated investment portfolios.

FX Overlay with BNY Mellon

Currency hedging strategies help funds to mitigate currency volatility risk. Fund investors are becoming increasingly aware of this risk and are asking more questions about a fund’s currency hedging program. In addition, the execution, timing and capabilities around a currency hedging program can have a significant impact on the end investor’s implicit costs.

As international business continues to expand, an efficient and cost effective cross-border payment service is essential. Making foreign exchange payments can be challenging, but let BNY Mellon help you.

FX Payment Service

- Send payments in over 100 currencies and receive payments in more than 35 currencies.

- Substantially decrease the need to maintain accounts in local markets.

- Leverage our offerings in FX and Transaction Banking by initiating payments from your account to pay beneficiaries globally.

- Access our dedicated local client services.

Extensive Network

BNY Mellon has an extensive global payments processing network. With our comprehensive service, you can send and receive cross-border payments through multiple channels.

Customization

BNY Mellon FX PaymentsSM allows you to customize the way you make FX payments, consolidate accounts, reduce time consuming reconciliation, lower account fees, and help efficiently manage your assets.

FX Program Trading desk provides you with transparent, rules-based currency execution, freeing you up to focus on your primary business goals.

All of our programmatic trading strategies benefit from price netting, meaning trades in the same currency pair, priced via the same program at the same time and in the same location receive the same base rate. FX Program Trading is also segregated from our FX Sales & Trading business, enabling us to execute your orders while minimizing market impact.

Our suite of non-discretionary trading solutions carry out your FX orders in a systematic fashion, providing you with low-touch means of gaining the passive currency exposure you require.

- Session Range: Session-based trading is useful if you’re executing transactions throughout the day. Calculating a rate by considering the market range over a predefined time period, one rate is determined per session.

- Defined Spread: For clients who want a more tailored execution program, defined spread enables execution of FX at a predetermined time during the trading day.

- Benchmark: This program tracks a prescribed FX benchmark or index.

- Bespoke Programs: These customized non-discretionary strategies can be designed to defined parameters you instruct.

- FX Algos: Our range of FX client algos enable you to manage your currency exposure utilizing a number of algorithmic strategies.

As part of our ongoing commitment to further improve the sophistication of our offering, we've added enhanced swap and options trading to our product lineup.

We have also:

- Established new onshore FX trading capabilities in South Korea and Latin America

- Continued investment in emerging markets and NDFs

- Committed to provide you with full flexibility to trade with us where you wish whether in the Americas, EMEA or APAC

So whether you’re looking to trade FX electronically or speak to one of our specialists about a less liquid product, you’re covered.

Electronic

We provide direct access to deep and broad pricing through our e-trading capabilities, and connectivity to an array of third-party platforms. Whether your preference is to access a central limit order book, take advantage of streaming quotes or launch a request for quote, it’s in your hands. Where can you find us?

- Bloomberg®

- Currenex®

- FXall®

- FX Connect®

- Direct API®*

- 360T®

- FlexTrade®

- EBS direct

- BidFX

- iFX Manager

- We’ll soon also be on Portware.

Voice

Not all trades are best serviced electronically. If you have specialist needs, want to trade more customized, less liquid instruments, or simply want to speak with an individual, our sales team can help.

They can guide you in tackling any trading challenge, regardless of size, and are on hand whenever you need them.

We also provide you with access to The Aerial View, our daily FX market strategy commentary, which gives you in-depth market intelligence and color only a human being can provide.